9. · Pengertian Buy, Sell, Buy Limit, Buy Stop, Sell Limit, Sell Stop dan Spread dalam Forex dalam forex tidak lepas dari Buy dan Sell (Beli dan Jual). Setiap trader memiliki kebebasan untuk melakukan salah satu aksi diatas yang menurutnya benar untuk memperoleh blogger.comted Reading Time: 2 mins A Buy limit order is triggered after a drop in value, a local bottom breakout, and an upward reversal. We enter the market after the set level is crossed. To fully understand the Buy limit and Buy stop, you need to see the difference between them. A Buy stop order is opened with an assumption that the trend is going to continue 1. · how to type forex market order|buy limit|sell limit|buy stop| sell stop| stop loss|very easy to learnWelcome Friends to 's Biggest Technical Analysis Youtub Author: Forex Pasha

Buy Limit vs. Buy Stop - Trader Group

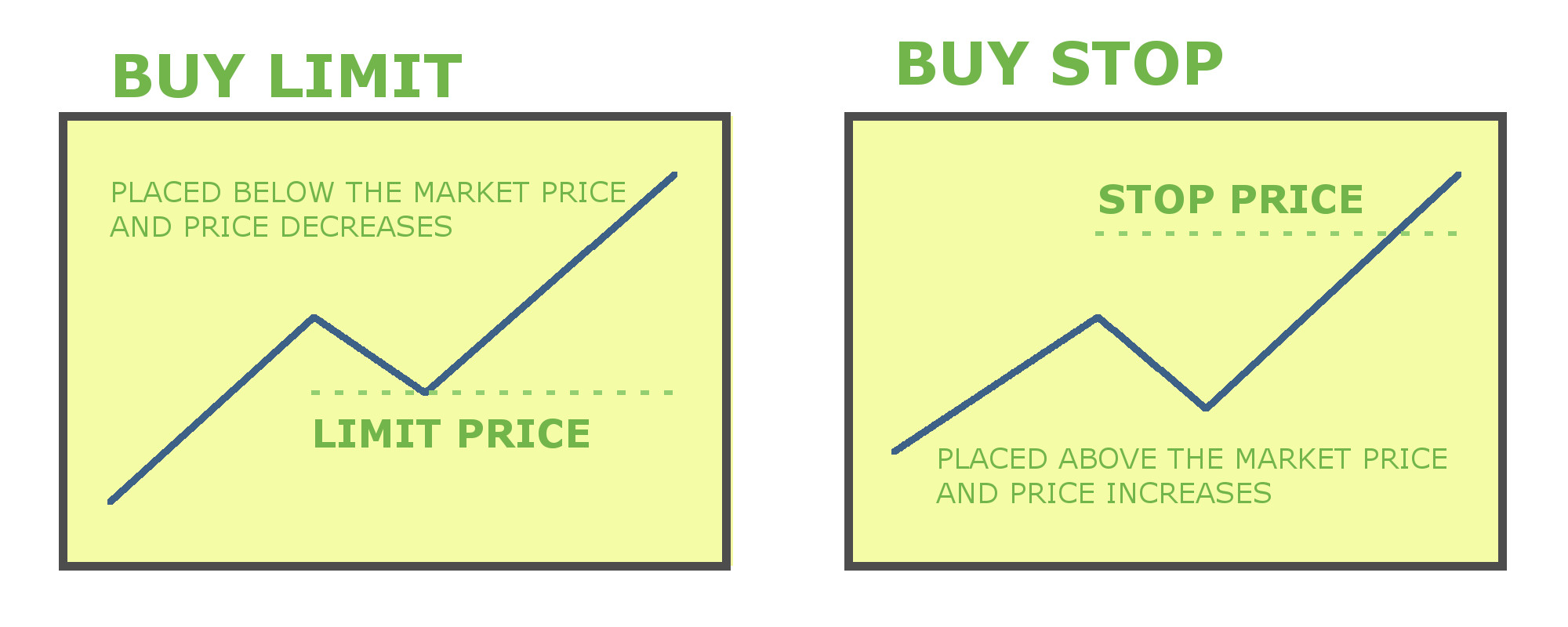

Reviewed by FXCM Team - 3 Maypm. For active forex tradersproperly locating orders is a key part of conducting day-to-day business. Understanding order functionality and how different types impact trade execution is critical to interacting within the market competently. If not, untimely mistakes can lead to lost opportunity, or worse, lost capital. On the buy-side of the equation, there are two order types that market participants need to be familiar with: buy limits and buy stops.

No matter if one is opening a new forex position, aligning profit targets, or positioning stop losses, these two order types are vital to entering and exiting the market efficiently. A 'buy limit' order is a buy order that is filled at a prespecified price or better.

Buy limit orders are classified as "pending," as they rest at market below current price until executed. Upon price action reaching the buy limit's designated point, the order is then filled. Buy limit orders may be used to enter the market in a "long" or "bullish" fashion and as profit targets for short positions. Rates are trending upward near intermediate-term highs above 1. Trader A is hopeful that if a price retracement occurs, bidders will enter the market in mass just above the 1.

In an attempt to join the uptrend at a beneficial price, Trader A uses buy limit orders to enter the long-side of the market:.

It's important to remember that buy limit orders are placed below price. Accordingly, can be used as profit targets for bearish positions. Buy limits may be used as profit targets accordingly:. A buy stop order combines the functionalities of a buy order and a stop-market order. Similar to buy limits, buy stops are pending orders, meaning that they rest at market until filled. However, buy stops reside above current price and are filled at the best available price when elected.

In the live forex, buy stops may be used to enter the market in a bullish fashion or act as stop losses for open short positions. Like buy limits, buy stops may also be used to open new long positions in the market. However, this is done in a much different way, as the buy stop order resides above current price action. Instead of waiting for a retracement, the buy stop furnishes the trader with an ability to enter the market with price action.

This functionality is especially useful for momentum or breakout trading strategies. The pair is trading in a prolonged consolidation pattern near 1. Trader A uses a buy stop order to play a breakout above 1.

Stop loss orders are a vital part of risk management and can save the forex trader from realising catastrophic loss. Buy stops are placed above price action, thus limiting the liability of active bearish short positions.

Functionally, buy stops are resting market orders; once elected, they provide an immediate exit from the market at the best available price. Further, Trader A has buy limit vs buy stop forex to implement a buy limit profit target at 1.

The buy stop is placed accordingly:. Although buy limit and buy stop orders both deal with the long-side of the forex market, they are unique devices. Below are the key differences:. In the live forex market, it's up to the trader to decide whether buy limits or buy stops are best-suited for the task at hand. Please note that all illustrations are only shown for the purpose of a technical demonstration and should not in any way be construed as recommending any type of trading strategy and they do not constitute any form of investment advice.

Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. As such, there are key differences that distinguish them from real accounts; including but not limited to, buy limit vs buy stop forex, the lack of dependence buy limit vs buy stop forex real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts.

There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Single Share prices are subject to a 15 minute delay.

Any opinions, news, research, analyses, prices, other information, buy limit vs buy stop forex, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination.

Although this commentary is not produced by an independent source, buy limit vs buy stop forex, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions.

For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here.

Risk Warning: Our service includes products that are traded on margin and carry a risk of losses in excess of your deposited funds. The products may not be suitable for all investors, buy limit vs buy stop forex. Please ensure that you fully understand the risks involved. Buy Limit Buy limit vs buy stop forex Buy Stop In Forex Trading Reviewed by FXCM Team - 3 Maypm No Tags. What Is A 'Buy Limit' Order?

In an attempt to join the uptrend at a beneficial price, Trader A uses buy limit orders to enter the long-side of the market: A buy limit order is placed at 1. If price hits 1. Upon the buy limit being filled at 1.

Profit Target It's important to remember that buy limit orders are placed below price. Buy limits may be used as profit targets accordingly: Trader A opens a short position from 0. This may be done in several ways, including the execution of a sell market order, a sell stop or a sell limit order depending upon the location of price.

For a short position profit target, the buy limit order is placed below price. Let's say that Trader A is aiming for a 25 pip gain. So, the buy limit is placed at 0. What Is A 'Buy Stop' Order? Market Entry Like buy limits, buy stops may also be used to open new long positions in the market.

Stop Loss Stop loss orders are a vital buy limit vs buy stop forex of risk management and can save the forex trader from realising catastrophic loss. The buy stop is placed accordingly: Trader A places the buy stop order at 1. This location is 25 pips from entry and adheres to the trade's risk vs reward parameter. Upon 1. Summary Although buy limit and buy stop orders both deal with the long-side of the forex market, they are unique devices.

Below are the key differences: Buy limit orders are located below current price; stop orders are located above current price. Buy limit orders are filled at a designated price or better; buy stop orders are filled at the best available price.

Buy limit orders are designed for precision; buy stop orders are intended to enter or exit the market immediately upon being elected, buy limit vs buy stop forex. Accordingly, buy stop orders are prone to slippage, whereas buy limit orders are not. Disclosure Demo Account: Although demo buy limit vs buy stop forex attempt to replicate real markets, they operate in a simulated market environment.

Ask FXDD - What are the differences between Buy Limit, Buy Stop, Sell Limit and Sell Stop?

, time: 3:40Types of Forex Orders - blogger.com

A Buy limit order is triggered after a drop in value, a local bottom breakout, and an upward reversal. We enter the market after the set level is crossed. To fully understand the Buy limit and Buy stop, you need to see the difference between them. A Buy stop order is opened with an assumption that the trend is going to continue 1. · how to type forex market order|buy limit|sell limit|buy stop| sell stop| stop loss|very easy to learnWelcome Friends to 's Biggest Technical Analysis Youtub Author: Forex Pasha 8. · What is Buy / Sell Stop and Limit Explained – Order Types in Forex Trading By Daffa Zaky August 17, , am • Posted in Education In forex,

No comments:

Post a Comment