5/18/ · The time frame in forex trading is a chart specified or general period of time in which traders open and close their positions. Based on the general time frame, trading can be long-term, medium-term, and short-term. Chart time frames in the trading platform can be M1, M15, M30, 4H, Daily, Weekly, Monthly, blogger.comted Reading Time: 8 mins 10/24/ · Forex trading time frames are commonly classified as long-term, medium-term and short-term. Traders have the option of incorporating all Estimated Reading Time: 4 mins 8/11/ · There are nine different standard time frames available to you. I say “standard” because there are some variations out there that we’ll get into in a moment. Those standard time frames are: 1 minute; 5 minute; 15 minute; 30 minute; 1 hour; 4 hour; 1 day; 1 week; 1 month; So even with just the standard time frames, you have a plethora of options to choose blogger.coms: 35

Why Are Bigger Time-frames So Important In Forex? | blogger.com

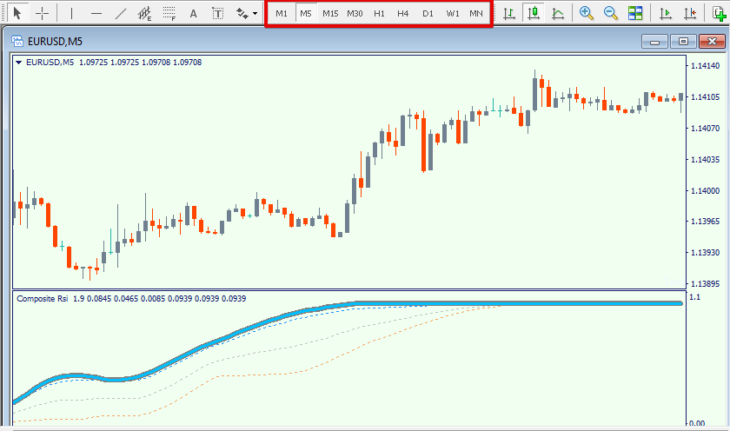

One of the earliest concepts that any trader exposes themselves to is that of time-frames. In forex, we are well-versed with the nine time-frames from the MT4 platform that range from the M1 one minute to the MN monthly. There are different schools of thought that traders subscribe to regarding smaller and bigger time-frames. Shorter time-frames have become synonymous with scalpers and day traders, and rightfully so. There are a few reasons why the latter is given so much importance in forex.

Market professionals refer to smaller time-frames forex time frames noise, though what exactly is meant by this? Since price moves every second, noise is the amount of these fluctuations occurring to the point of irregularity or unclearness.

This erratic behavior makes it very challenging to predict price movements consistently. The further up you go, the smoother the markets appear. We can compare time-frames as different storybooks. Bigger time-frames essentially provide a synopsis of the broader market story, a summary of all the main points that occurred.

With bigger-time frames, forex time frames, the amount of screen time required is drastically forex time frames than the former.

Forex time frames the dimension of time in forex is another interesting factor, forex time frames. Time in the markets operates slightly differently than the reality we know.

While this statement may seem strange, it reinforces the idea of why patience is arguably the single most critical characteristic forex time frames trader can possess. The 1-hour signal would suggest that in an hour, there would have been a strong fake-out to the upside where sellers started to drive price back down aggressively. Now, if the exact signal appeared on the daily chart, because it would have taken a full 24 hours to form, this is much more significant.

This event would signal that even with such an extended period, buyers appeared to lose much of the fight against sellers.

The probability that the sellers would win the fight after an hour is less probable because this is a shorter time in the bigger scheme of things. A greater scope of time holds more weight. One achieves a top-down approach when analyzing higher time-frames. The image below highlights this idea eloquently, forex time frames.

We can see below that the clearly defined daily pin-bar on the daily chart was powerful enough to drive the downtrend that lasted for a few months. One of the reasons why the daily close is crucial is that the market events occurring particularly after the New York session 08h30 Forex time frames time have a massive bearing. As this is the busiest of all sessions, forex time frames, traders watch it closely and equally in the aftermath when markets are less volatile and calmer.

At the stages towards the daily close, this can often signal what is likely to happen in the next coming days or even longer. In essence, forex time frames, the closing price is like a confirmation factor. In as much as distinct forex time frames on bigger time-frames exist, a seismic psychological shift has to occur to be in sync with them.

This shift is one of the main disadvantages simply as trading in this style can be a forex time frames challenge, even for the most experienced. By its very nature, the forex markets are a lot slower than we may want them to be. Every trader yearns for big moves, yet such moves are rare and can take very long to manifest.

Though with bigger time-frames, quality matters a lot more than quantity. The industry currently makes it seem that one has to consistently engage with the markets like a regular 9 to 5 job.

With bigger time-frames, the possibility exists to dabble in numerous ventures and still maintain a profitable track record with your trading account, which is more stress-free physically and mentally, forex time frames.

Save my name, email, and website in this browser for the next time I comment. Click or touch the Plane. Check out our list of best forex robots. RELATED ARTICLES MORE FROM AUTHOR.

How to Stay Ahead of The Forex Market Using News Release. Balancing Your Portfolio as a Position Trader. How to Spot and Use Ascending Triangles in Forex Trading.

LEAVE A REPLY Cancel reply. Please enter your comment! Please enter your name here. You have entered an incorrect email address! USD - United States Dollar. You must be aware and willing to accept the risks to invest in the markets. Never trade with money you can't afford to lose. Past performance of any results does not guarantee future performance. Therefore, no representation is being implied that any account can or will achieve the results indicated in this website.

EVEN MORE NEWS. Arya Review. June 3, Disclaimer Privacy Policy About Us Get In Touch. Best

Forex Trading Technical Analysis: Using Multiple Timeframes to Enter \u0026 Exit! ��

, time: 9:38Time Frames of Forex Trading: A Beginner’s Guide

9/19/ · So what does all these timeframes M1, M5, M15, M30, H1, H4, D1, W1, and MN mean in Forex trading? The timeframe label indicates the amount of time one candle refers to. The larger the timeframe chosen by a trader, the larger the time interval encompassed in one candle on the blogger.comted Reading Time: 5 mins 5/18/ · The time frame in forex trading is a chart specified or general period of time in which traders open and close their positions. Based on the general time frame, trading can be long-term, medium-term, and short-term. Chart time frames in the trading platform can be M1, M15, M30, 4H, Daily, Weekly, Monthly, blogger.comted Reading Time: 8 mins 8/21/ · Every time frame is important in the forex market. There are two common time frames; long-term time frame and short-term time frame. These time frames are transmitted through to trends and trigger charts. Trend charts are for long-term frames. They guide the traders in recognizing the blogger.comted Reading Time: 6 mins

No comments:

Post a Comment