5. · When you fund a FOREX trading account, the money in your account is your margin, and acts as total collateral for your trades. Leverage basically means the Maximum Amount arranged between you and your Broker that they will lend against your capital (margin).Estimated Reading Time: 7 mins 5. · Leveraged products, such as forex trading, magnify your potential profit - but also increase your potential loss. Leverage is a key feature of forex trading, and can be a powerful tool for a trader. You can use it to take advantage of comparatively small price movements, ‘gear’ your portfolio for greater exposure, or to make your capital go further 7. · Forex leverage is the financial leverage provided by a Forex broker that allows a trader to open positions with the funds, several times (up to 1: and more) exceeding the amount of the trader's own blogger.com: Oleg Tkachenko

Risks and Rewards of Leverage in Forex Trading - My Trading Skills

You are Here: Home » Forex Education » What is Leverage in Forex Trading? Whether you are leverage in forex trading broker, full time, or part time day trader, everyone has the same reason for getting into forex…. To make MONEY! Are you making as much as you would like to be? Probably not. Want to learn how to make more? Of course you do. Leverage is essentially a loan that is provided to an investor from a broker who is handling their Forex account.

When an investor chooses to invest in the Forex Market, they must open a Margin Account with a broker. Typical leverage amounts range from to as high asdepending on the particular broker and how large the position is that the investor is trading. Normal trading is done based onleverage in forex trading, units of currency, the leverage usually provided for this size trade would likely be or Forex leverage is no different and the better you leverage in forex trading perfect and make the most of yours, the more you stand to make.

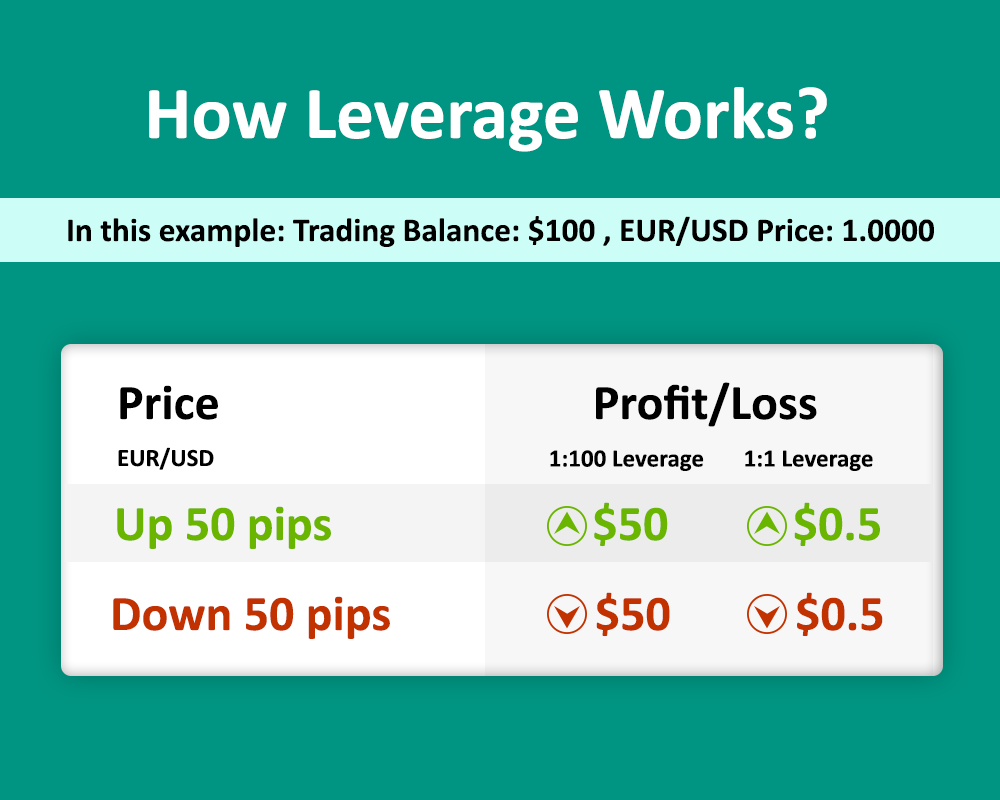

When you fund a FOREX trading account, the money in your account is your margin, and acts as total collateral for your trades. Leverage basically means the Maximum Amount arranged between you and your Broker that they will lend against your capital margin. Leverage is usually quoted as a ratio such as, or Simply put, a ratio of 1 means that you can trade units of currency while only putting up 1 unit.

The reason successful forex currency traders use leverage to make their profits skyrocket is that a single pip is low and you have to trade large lots of currency to make a profit.

Many beginning traders cannot afford to. However, if you believe you have a good forecast on the market, you can trade more than one lot. The number of lots you can trade depends upon the margin in your account not the amount you deposited. Included in that are any open trades you have running, taking into account any profits or losses you may incur. With Forex market being so liquid, brokers can offer you this extremely high leverage because they almost never have to worry about you owing them money back if the trade goes bad.

Margin call policies at many brokers are usually designed to issue a margin call on your account well before a negative balance occurs.

With some brokers, however, the market may move against your position too rapidly, and you may incur a total loss of your funds and even a negative balance. Leverage leverage in forex trading the trader the ability to make huge profits, and at the same time keep risk capital to a minimum. Traders must remember that in forex, leverage leverage in forex trading a double-edged sword: while it can multiply your gain potential exponentially, leverage in forex trading, it can equally magnify your loss potential.

Abuse it and you might find yourself broke in no time. Leverage in the context of currency trading means using a smaller amount of a currency for a position instead of putting up the full amount. This is the same as trading on margin and it can be an extremely risky thing to do.

The leverage generally provided on a trade like this is This amount of leverage is drastically more than the leverage most often provided on equities, leverage in forex trading, and the leverage usually provided by the futures market.

Brokers would not offer as much leverage if the fluctuation was as high as equities and futures. There is an ability to earn substantial profits using leverages, however, leverages can also work against an investor. For example, if the currency moves the opposite direction you thought it would leverage will multiply the potential loss by the same factor as it would multiply the gain.

Forex traders usually take advantage of stop and limit orders that reduce the risk and can prevent you from suffering a huge loss. Using a smaller leverage like for instance can help you when starting out and keep you from losing too much too fast.

When trading in Forex it is imperative to understand the leverages and what they mean to your real trading capital. Beginners should always use practice accounts to learn the system and get a feel for how the process works.

Take advantage of all of the tools and tracking information that is made available and be careful about using leverages that are too high.

Some brokers offer up leverages, however,this high of leverage can wipe out your entire trading account quite quickly with even a small change in the opposite direction of your predictions. Generally speaking the speculator loses in any high leverage in forex trading and high risk leverage trade. The good news? Save my name, email, and website in this browser for the next time I comment, leverage in forex trading.

Skip to content. Home About Apply for Training Book Appointment Education How to Start Forex Trading. What is Leverage in Forex Trading? So what exactly is Forex leverage?

Leave a Comment Cancel reply Comment Name Email Website Save my name, email, and website in this browser for the next time I comment. Recent Reviews. Is HotForex A Good Forex Broker for Kenyans? TemplerFx Review — The Most Detailed Review for Kenyans.

XM Forex Broker Review. FXPesa Review — Is FXPesa A Legit Forex Broker. Iron Trade Broker Review. Close Home About Apply for Training Book Appointment Education How to Start Forex Trading, leverage in forex trading. Download this free eBook to learn how succeed with forex using the power of your mind. Written by Patrick Mahinge, leverage in forex trading, CEO, Kenya Forex Firm. Good things come to those who sign up for our newsletter.

Welcome to the 1 Forex Newsletter in Kenya. Give it a try, you can unsubscribe anytime.

Lesson 10: All about margin and leverage in forex trading

, time: 23:38How Much Leverage Is Right for You in Forex Trades

5. · When you fund a FOREX trading account, the money in your account is your margin, and acts as total collateral for your trades. Leverage basically means the Maximum Amount arranged between you and your Broker that they will lend against your capital (margin).Estimated Reading Time: 7 mins 1. · Leverage is a process in which an investor borrows money in order to invest in or purchase something. In forex trading, capital is typically acquired from a 7. · Leverage on Forex is the amount of trading funds that the broker is willing to lend to your investment based on the ratio of your capital to the amount of credit funds. The total amount of leverage provided by the broker is not constant. Brokers set their rates, which in some cases can reach or even blogger.comted Reading Time: 7 mins

No comments:

Post a Comment