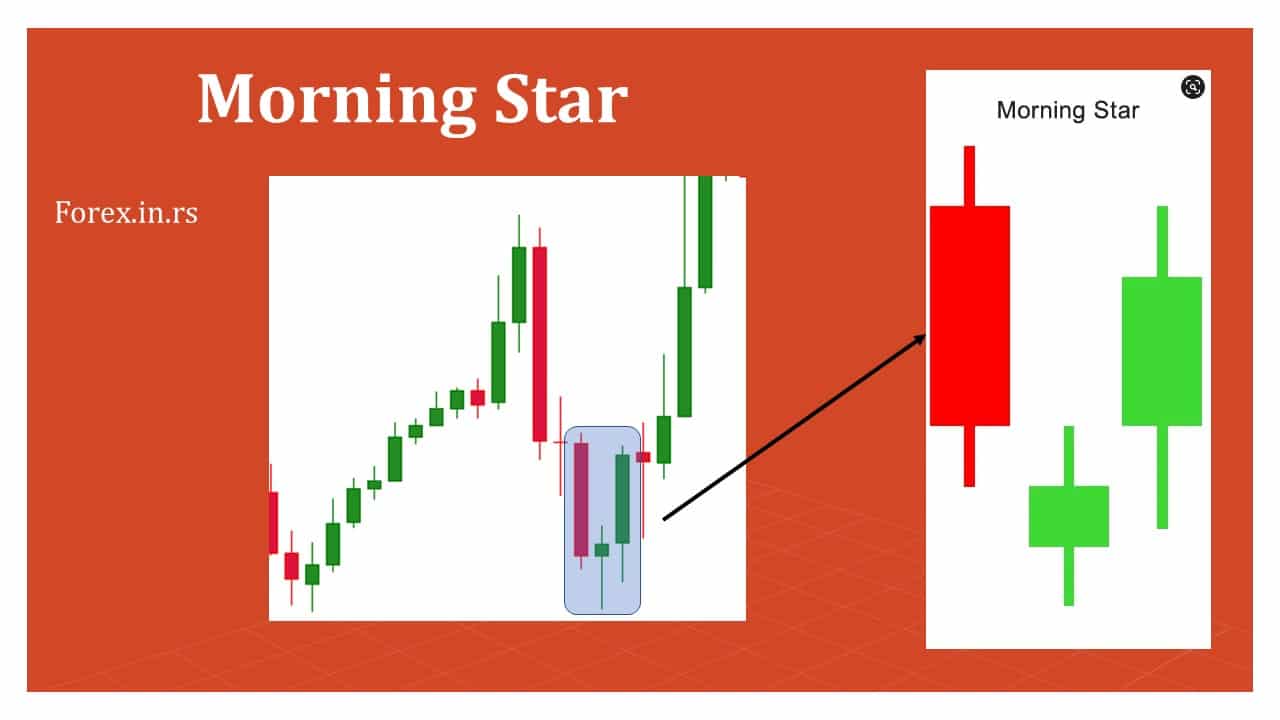

/01/08 · The Morning Star is a candlestick pattern that is comprised of three candles. A completed Morning Star formation indicates a new bullish sentiment in the market. It is considered a reversal pattern that calls for a price increase following a sustained downward trend Catching the turn of a major trend reversal can be profitable and the morning star candlestick pattern is a great price action pattern to look at for catching a market reversal.. Candlestick patterns, while not perfect, can allow a trader to catch a trend reversal because they do highlight the change in market sentiment. Some candlestick patterns such as the morning star reversal pattern, are Estimated Reading Time: 3 mins /01/06 · The Morning Star is a Japanese candlestick pattern that usually appears at the end of downtrend in Forex. They are the starting point for the uptrend of prices. Mastering this entry point will help you open options with a high win rate.4,5/5(26)

Morning Star Candlestick Pattern - Catch The Turn | Forex Trading Strategies

Catching the turn of a major trend reversal can be profitable and the morning star candlestick pattern is a morning star forex price action pattern to look at for catching a market reversal. Candlestick patternsmorning star forex, while not perfect, can allow a trader to catch a trend reversal because they do highlight the change in market sentiment.

Some candlestick patterns such as the morning star reversal pattern, are a little better at it than others. Acting as a bullish reversal pattern, we need to have a market in an obvious down trend. Markets in consolidations are a little less predictable between the extremes but you could look at lower time frames for a trend while the higher time frame is consolidating between support and resistance, morning star forex.

Once we have a market in a down trend, traders need to have a reason why the market could be looking at a bullish reversal, morning star forex. Once you have determined the market is in a down trend using a candlestick chart for easier viewing morning star forex lower highs and lower lows the next step is to see if there is a technical reason for a potential reversal.

Taking a trade at a random location morning star forex a chart simply because a candlestick pattern has shown up is not smart trading. Build the case as to why you are willing to put risk on in the market before you ever hit the buy button. What are we really looking for when seeking to take a reversal type trade? We are looking for the current trend to exhaust itself in some manner and then have the opposing side looking for buyers or those exiting short positions step in to drive the market.

This graphic shows a market in a down trend with obvious bearish candlesticks into the low. A morning star forex candlestick appears any color is fineperhaps an indecision candlestick such as a doji or spinning top, by gaping below the body of the down candlestick.

Often times strong momentum is slightly retraced but the failure of this reversal pattern is a continuation of the previous trend direction. When trading any reversal pattern, the probability is that the previous trend will resume and traders should have proper risk protocols in place.

Traders would want to watch for any momentum against the third candle in the pattern which is the bullish candle.

The key is to watch for positive follow through to confirm the reversal. If the new direction is to be sustained, while we expect a slight pullback, in the end we need the market to start putting in higher highs and lows to confirm a new trend direction. Where To Look For Morning Star Candlestick Pattern Once you have determined the market is in a down trend using a candlestick chart for easier viewing hint: lower highs and lower lows the next step is to see if there is a technical reason for a potential reversal.

Prev Article Next Article.

Morning Star + Evening Star Candlestick Patterns Explained

, time: 6:46Morning Star | blogger.com

![Morning Star Forex[% Fully Explained] - forexmastery HQ morning star forex](https://media.dailyfx.com/illustrations/2013/08/19/Trading_the_Bullish_Morning_Star_body_Picture_1.png)

/10/22 · %, morning star forex pattens form on every single time frame. Be it 1 minute all the way to your weekly charts. How relevant is the chart pattern. The morning star formation is a very strong trend reversal pattern. Whenever it forms on charts that you trade it is definitely worth blogger.comted Reading Time: 7 mins /09/23 · A morning star pattern, in Forex, is basically a variation of the bullish engulfing pattern. However, the second candlestick in this three-candle formation must be a low range candle, like a spinning top or doji (not required in a regular engulfing pattern).Estimated Reading Time: 6 mins /01/06 · The Morning Star is a Japanese candlestick pattern that usually appears at the end of downtrend in Forex. They are the starting point for the uptrend of prices. Mastering this entry point will help you open options with a high win rate.4,5/5(26)

No comments:

Post a Comment